Have you heard the saying “time is money”? Well, it's true!

When it comes to building wealth, the key is to start investing early. If you start to contribute to your retirement account early, your money will have more time to earn compound interests and grow.

A recent Bankrate study found that 19% of working Americans aren't saving anything for retirement and only 25% are saving more than 10% of their annual income. Are you one of them?

If you haven't started to save for retirement, start today! Here six tips to boost your retirement savings.

1. Maximize employer matching for your 401(k) contributions

Even if you can't max out your 401(k) contributions, you should always meet your employer's match. It's free money! Take advantage of it.

Let's assume your employer matches 50% of your contributions, up to 5% of your annual income. If you earn $50,000 per year, you'll get an extra $1,250.

In 2017, limits on 401(k) contributions are $18,000 for people under 50 and $24,000 for those over 50. If you wish to put even more towards retirement, consider opening an IRA (Individual Retirement Account).

If you have a retirement account but have no idea if it's set up right, consider getting a free analysis from Blooom to see if you would benefit from any adjustments to your current 401(k).

2. Pay taxes to receive the highest Social Security benefits

Did you know that avoiding taxes can hurt your retirement benefits? This doesn't mean you shouldn't make the most out of tax breaks, just don't skimp.

Social Security retirement benefits are based on your lifetime earnings and how much you paid in Social Security taxes. So, the more money you contribute, the more you'll receive during retirement. Many retirees even end up getting more out of Social Security benefits than they actually put into the system.

3. Buy a home that you can afford and pay it off

Buying a home isn't always the right decision — if you have lots of debt, move around because of work, or plan to travel during retirement. But when it is, buying a home can save you a substantial amount of money and worry during your retirement years. You won't have to worry about finding a place to live or paying rent.

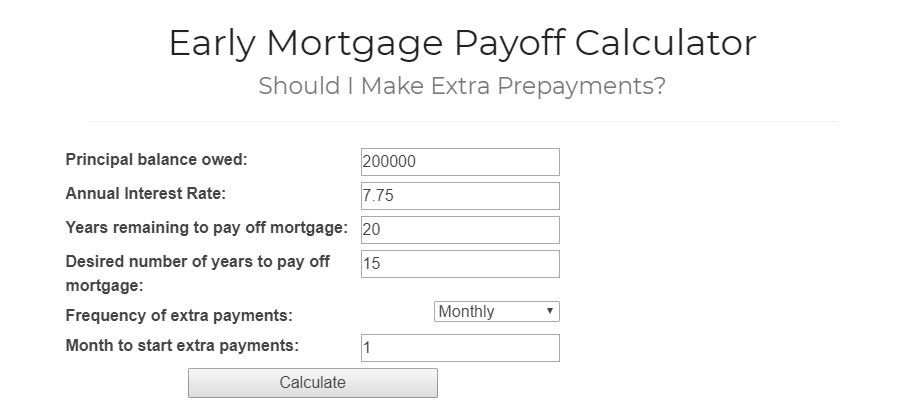

The trick is to buy an affordable home and pay it off as quickly as possible. Earlier mortgage payments have more impact because of the way interest is compounded. Paying more than the minimum will save you money and time.

For example, the average 30-year fixed rate mortgage in the U.S. is $200,000 with an interest rate of 3.8%. If you make the minimum payment of $932 you'll eventually pay off your mortgage, but you'll pay $135,000 in interest. But as an early mortgage payoff calculator shows, just $50 extra a month can save you $15,000 in interest and help you pay off your home 3 years earlier.

4. Automate deposits into your investment accounts

Automating deposits to your 401(k), IRAs and non-retirement investment accounts can make saving for retirement much easier.

If you take out the money out of your paycheck before you even see it, you won't run the risk of spending it on an extra meal out. Also, you won't have to worry about forgetting to make a contribution and miss out on compound interests.

Consider scheduling direct transfers into a robo-advisor like M1Finance or a real estate platform like Fundrise when you receive your paycheck. Then your money will grow without any effort on your part.

5. Earn extra income on the side

With the help of the internet, you can find many ways to make a few extra dollar (or a fortune) on the side.

One popular ways to make a few extra bucks online is by filling out surveys. Some of the most popular and best-paid surveys sites include Swagbucks, MyPoints Surveys, Ipsos iSay, Harris Poll and My Survey. These sites pay you with redeemable points, gift cards, prizes or cash.

Meanwhile, there are literally hundreds of ways to make money online and off. You just have to find a way that's fun and profitable – and get to work. Do online odd jobs on Fiverr or teach English online with VIPKid. You can even make a few bucks by referring friends to websites and services that you enjoy using. Check out our list of side hustles here.

Side hustles can have a massive payoff. In fact, if you worked 4 hours a week on the side for $20/hr, and invested what you made, you could be a millionaire in 30 years. That's without saving a penny of the income from your day job!

6. Skip out on the lottery and find other ways to win

The average lottery player spends more than $325 on tickets every year.

Instead of spending money on lottery tickets (and I'm sorry, but you're more likely to be hit by a car on your way to buying a ticket than to win), consider using lottery alternatives like sweepstakes and prize-linked savings accounts. These alternatives are free and still give you opportunities to win without losing a single cent.

Invest the $325 you would have wasted on lottery tickets and see it grow. If you invest that money at an 8% annual return for 30 years, you'll have more than $40,000 extra saved when you retire.

A great giveaway to get started with is A Richer You's basic income giveaway – where you could win $500/month for two years!

Conclusion

As the number of pensions declines, the future of Social Security becomes uncertain, and the cost of healthcare continues to rise, you need to prepare for retirement seriously.

Whether it's cutting your monthly expenses or getting a side hustle, find ways to boost your retirement savings today – and then start investing. With some creativity and thought, you can prepare yourself for retirement at any age.