Your kid is already (obviously) the best looking, smartest, and most athletic kid around – but what if you could make them the richest as well?

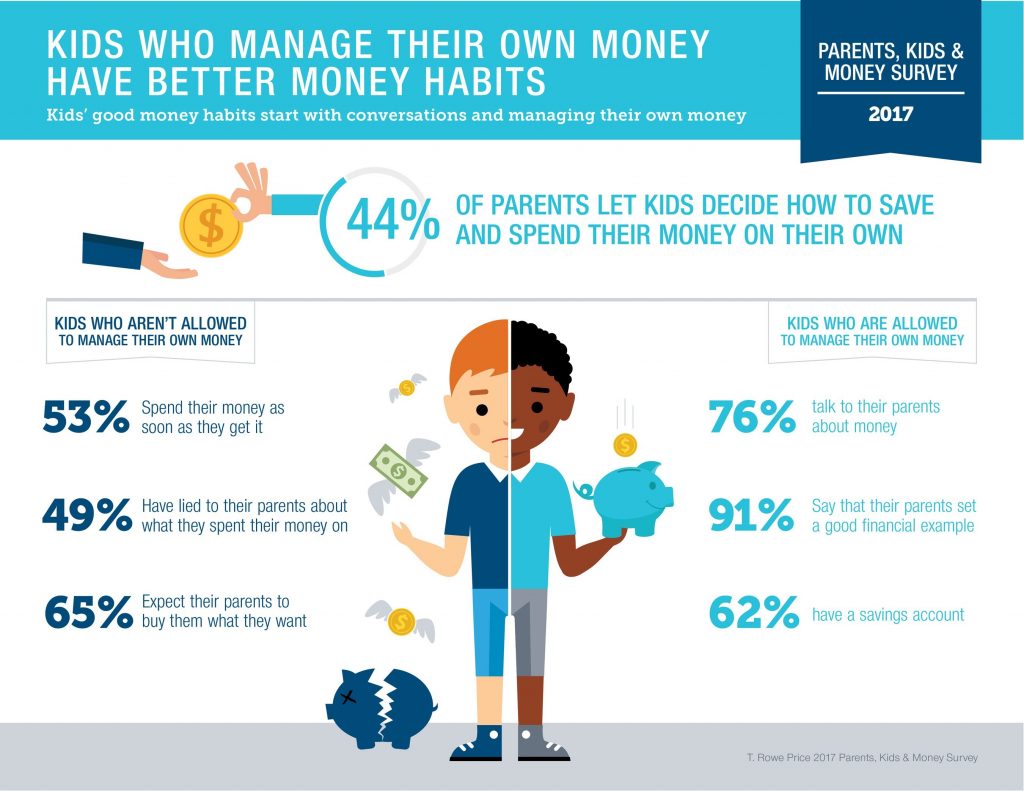

Teach your kids about money early on, and they'll start down the path to a financially secure future. According to the 9th Annual T. Rowe Price Parents, Kids and Money Survey, parents who talk to their kids about finances at least once a week are more likely to have kids who feel smarter about money.

The T. Rowe Price survey also stresses the importance of modeling smart financial behaviors, but letting your kids make their own decisions regarding their money. Below are 5 unique ways to help your kids earn money and begin to learn that it doesn't grow on trees.

Do this, and your kid will be well on her way to being the next Warren Buffett (or at least, financially secure).

1. Pay your child to work and/or learn

Consider skipping the traditional weekly allowance and instead offer your child payment for specific tasks.

Think creatively about what your child could use a little extra motivation to complete and how to work that into a payday for your kids.

Revamp your children's chore charts to include different amounts the child can earn for doing a specific chore.

Is your child struggling to keep up in reading or math? Encourage them to practice by paying them per page (or chapter, or book) or per extra math worksheet (handmade or found online). Get your kids outside and exercising by paying them per mile biked, ran, or walked (or per lap around the block for younger kids).

Consider setting a weekly or monthly limit to what your child can earn, somewhat in line with what you'd be comfortable giving as an allowance, and price tasks accordingly. This method puts how much your child earns (up to the predetermined limit) in their hands.

2. Open “The Bank of Dad (or Mom)”

Delayed gratification is a hard concept for young kids to grasp. Start out by reading “Rock, Brock, and the Savings Shock” with your younger kids. Then explain that you like Rock and Brock's grandpa's idea to match any dollar that they save so much that you'd like to do the same for them.

Delayed gratification is a hard concept for young kids to grasp. Start out by reading “Rock, Brock, and the Savings Shock” with your younger kids. Then explain that you like Rock and Brock's grandpa's idea to match any dollar that they save so much that you'd like to do the same for them.

Encourage your children to set a goal for what they'd like to buy, discuss how much they need to save to reach the goal, and talk about what tasks they can complete (see above), what business they can start (see below), or what other ways they can earn the money they need.

Another idea for kids who are older or maybe don't have a specific savings goal would be to pay additional interest on money they choose to save for a month or longer. Mr. Money Mustache does this and it's a great concept.

For older kids, you could even allow them to buy and sell their own stocks using a custodial account on Stockpile. Get them learning how to invest early on and they'll be well on their way to a financially secure future.

3. Encourage your child to start a business

Kids are thinking beyond lemonade stands and paper routes to come up with creative ways to make money.

Warren Buffet himself is a big fan of encouraging entrepreneurship in children after selling gum door to door as a child helped propel him to where he is today. A great resource for parents looking to help their child start a business can be found at Warren Buffett's Secret Millionaires Club website.

Is your kid talented at or passionate about something? Brainstorm with them to see if it could be a business opportunity!

Open up an Etsy store with your artistic child who makes jewelry or paints. If your child likes being in the kitchen, help them host a bake sale or make homemade doggie treats to sell. Of course, there's nothing wrong with a good ol' lemonade stand!

Who knows, maybe you can turn your 6 year old into an $11 million/year YouTube star.

4. Read fun money books together

Turn reading time into learning time with one of the many great books written for kids about money. A quick Google search is sure to provide some great options for your child's age, along with some favorites listed below.

Turn reading time into learning time with one of the many great books written for kids about money. A quick Google search is sure to provide some great options for your child's age, along with some favorites listed below.

“Berenstain Bears' Dollar$ and $en$e” is a great book that allows your kids to read along as Brother and Sister learn about money and what it means to budget and save. Mama develops a checkbook system to help Brother and Sister learn these principles, which is a great idea to put into practice in your own home after reading and discussing this book with your kids!

Other books that will help your children learn to understand money include “If You Made a Million,” “Alexander, Who Used to be Rich Last Sunday,” and “A Smart Girl's Guide: Money” for girls aged 10 and up.

5. Have your kids start investing

Most adults don't understand investing. If you can help your kids grasp how the stock market works, they'll be well on their way to financial security. Tell your kids that they are able to own a small piece of the companies that they really like (like Disney, Hasbro, Facebook, etc.) and make money when those companies make money!

One great way to start introducing your kids to the stock market is through Stockpile, an app that allows kids to buy and sell stock in dollar increments rather than shares (for example, they can purchase $5 of Amazon). Anytime they request to buy or sell, a notification is sent to their parent (or other account custodian) who can then confirm or deny the trade.

Just think, your son or daughter could be the next Warren Buffett before they turn 18.

6. Be open to talking about money as a family

Too many families make money a taboo subject, which can result in generations of poor money choices. Be open and honest about your own financial struggles, allowing your kids to learn from your successes and failures.

If you have to tell your kids “no” when they ask for something, help them understand why by explaining that saying yes to this might mean something important wouldn't get paid instead. Telling your child that buying an expensive new toy today would mean less money to spend on food for the week is a great way for your child to start learning the value of a dollar.

Additionally, talk to your kids about ways that making smart choices provides the opportunity for the family to do fun things as well! If you've saved money in certain ways that allows you to take a fun outing or go on a family vacation, explain this to your kids so they can start connecting the dots that saving money is worth it!

To better understand how to bring up financially intelligent children, consider adding “The Millionaire Next Door” and “Rich Dad Poor Dad” to your own reading list.

By teaching your kids about money today, you can help them establish the habits and mindsets necessary to earn more, save more, and contribute more to society.

Do you have any strategies for teaching kids about money? Share in the comments below!

This article was written by Amber Miller.