Over the last three months, my Bitcoin investment has tripped – as the value of Bitcoin has shot up from $5,000 to over $15,000. With Bitcoin up almost 2000% this year, I know many people are wondering if now is a good time to buy, or if the ship has sailed.

So today, I am going to answer the question: Should I invest in Bitcoin?

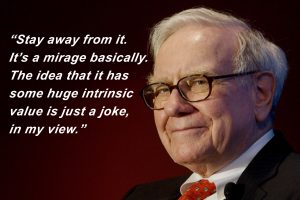

Photographer: Norm Betts/Bloomberg News

With experts like Warren Buffett saying it's a bubble, should we all stay clear? Not necessarily.

I've been hesitant to write about Bitcoin for some time because my goal is to assist my readers in growing wealth intelligently. While I certainly believe that Bitcoin has risks – and you should only invest what you can afford to lose – I have seen a huge upside, and I believe I would be doing my readers and friends a disservice if I didn't tell them what I thought about Bitcoin.

I recommend reading this article before investing. However, if you're ready to invest now, the two tools I use to buy Bitcoin are:

- Coinbase: This website/app is the leading platform for buying and selling Bitcoin, and operates a bit like PayPal. Just connect your bank account or credit card and you're good to go. Right now A Richer You readers can receive $10 worth of Bitcoin if they set up an account and invest $100. Claim $10 in Bitcoin now.

- Stockpile (buying the GBTC Investment Fund): GBTC is a Bitcoin investment fund that trades on the stock exchange. While you can buy this fund on most trading platforms, I like using Stockpile because they allow you to buy in dollar amounts rather than shares (which are priced over $1,600 right now) – for just $0.99/trade. Right now Stockpile will give you $5 to invest in any stock (including Bitcoin) just for signing up! Get your $5 to invest in Stockpile.

Every investment is risky…

Because I'm not a financial adviser, take my advice with a grain of salt. In fact, even when you do talk to a financial advisor, don't assume they have all the answers.

No one can predict what will happen tomorrow with 100% accuracy. All we can do is make the smartest decision based on the information we have and hope for the best (this is true in life, not just investing).

No one can predict what will happen tomorrow with 100% accuracy. All we can do is make the smartest decision based on the information we have and hope for the best (this is true in life, not just investing).

But sometimes, taking a risk can pay off! For example, take this guy from the Netherlands who sold everything he had and moved his family to a campsite in October of 2017. He then invested all of his money in Bitcoin.

People called him crazy, but he's just tripled his net-worth in three months – while most of us Americans have blown money on Black Friday deals.

Of course, even though I am an advocate for Bitcoin, I don't recommend selling everything to invest in cryptocurrency. Here's why…

The risk associated with Bitcoin

From 2013 to 2015, Bitcoin dropped from a high of $1,100 all the way down to $200. And it could drop again.

Bitcoin's only value is the value that people place on it. And with the incredible fluctuations we've seen with Bitcoin in the past, it's not unreasonable to see it drop again. In fact, it can drop 20% in a day.

Because of this instability, I agree with traditional investment advisors. It is not where you should place your retirement savings.

Because of this instability, I agree with traditional investment advisors. It is not where you should place your retirement savings.

Just a few weeks ago I was tempted to borrow from my retirement account to buy Bitcoin! Although the allure of doubling my money was hard to pass up, I decided against this impulse. And I recommend you do the same.

Only buy Bitcoin with money you are okay losing.

However, I also believe Bitcoin and other cryptocurrencies will continue to increase in value. If you only invest money you can afford to lose, and you play the long game, I believe you'll continue to see your Bitcoin investment go up. Here are a few reasons why I'm bullish on Bitcoin.

10 reasons why Bitcoin will go up in value in the long-term (and why I think it's a good side investment)

Again, I must caveat this by saying that I am not a financial advisor, and people much smarter than myself will tell you not to invest in Bitcoin.

However, those same people have been talking negatively about Bitcoin from the beginning – while Bitcoin investors have seen $1 turn into $1 million (boy wouldn't that have been nice!).

So, from my current understanding of Bitcoin, here is why I believe it's still a great investment.

1. Bitcoin is not a company, it's a cash / gold equivalent

Warren Buffet doesn't like Bitcoin because he says “it's not a value producing asset”. But neither is cash or gold. The only reason the US dollar has value is because people perceive it as having value. Otherwise it's just tiny piece of paper.

As you'll see below, there are many benefits of Bitcoin as a digital alternative to traditional cash/currency. And because enough people have determined that it's valuable, I see that value remaining.

2. There's a limited supply of Bitcoin

There will only be 21 million Bitcoin ever mined. What does that mean? Like gold, it's a limited resource. Gold has continued to increase in value over the years, and many people (including the first Bitcoin billionaires, the Winklevoss brothers) see Bitcoin as a digital gold.

This limited supply of Bitcoin means that the price will continue to rise as more people purchase the currency.

3. (Most) investors are only investing what they can afford to lose, and holding their investments long-term

At this point, most investors are (wisely) only investing what they can afford to lose. Why is this beneficial? I believe that this means investors will be less inclined to pull their money out when it does dip.

With the stock market, a drop can result in someone losing all of their retirement savings – which causes many investors to sell the moment the market looks unstable.

Meanwhile, with Bitcoin, most people who have a few hundred or thousand dollars invested may be more willing to brave out a small dip.

Furthermore, most Bitcoin investors are in it for the long game. When investors see that Bitcoin has 30x in value over the last year, most are interested in holding the currency, even during dips, with the anticipation that it could be 30x higher for them by this time next year (although the gains probably won't be that high).

4. Many investors have automated recurring investments

There are many Bitcoin fans who have budgeted Bitcoin into their regular spending. It's not uncommon for someone to schedule a $25-100 deposit into their Coinbase wallet after every pay check.

These automated recurring deposits mean that more money is continually flowing into Bitcoin, increasing the price even further.

In fact, part of my budgeting for 2018 includes regular purchases of Bitcoin and other cryptocurrencies.

5. Bitcoin is growing in popularity among mainstream investors

Traditional investors can already use investing sites like Stockpile to buy into the Bitcoin Investment Trust (GBTC).

Meanwhile a futures market has just been approved – bringing Bitcoin even more into the mainstream. And there's discussion of a Bitcoin ETF – which would make it even easier for everyday investors to buy into the digital currency.

If Bitcoin does become a staple in retirement accounts, it will certainly create a spike in value as more money flows into the currency. However, this could also lead to lower returns in the long run (after a big increase in value in the short-term).

6. More businesses and startups are accepting Bitcoin and other cryptocurrencies

Bitcoin was created to be a currency, not an investment. And more businesses are starting to accept Bitcoin as a method of payment.

Meanwhile, there is an ever-growing list of startups that are built around Bitcoin. This acceptance of the currency by businesses is what legitimizes its worth.

7. Bitcoin is not tied to any one government or currency

Another benefit of this cryptocurrency is that there is no government backing it.

This helps insulate it from any one economy's financial troubles.

In fact, I believe that Bitcoin will likely increase in value if the US stock market begins to dip and investors look for alternative places to store their money.

Without a government to control the currency, it's harder for legislative decisions from a single government to have a long-term impact on the currency.

8. Bitcoin removes trade borders

Transferring money from one country to another can get very expensive. However, Bitcoin exchanges cost the same regardless of location. You can send money to your neighbor, or to the other side of the world, without any extra costs.

While this would be valuable at any point in time, with the global growth of nationalism, Bitcoin may provide a way to make international transfers easy if governments begin restricting the freedom of their citizens.

9. Bitcoin is untraceable (like cash)

The initial rise of Bitcoin was due to its inability to be traced.

While all of our bank transfers and credit card purchases are tied to our names, accounts, and social security numbers, Bitcoin is like cash and cannot be traced.

A digital world has little use for physical dollar bills. However, there are many reasons (not all ethical) why a digital world would still want a form of currency that cannot be easily traced.

But it's not just drug dealers who are attracted to this – anyone who doesn't like the idea of a government being able to control who buys and sells finds a degree of appeal to a digital cash equivalent.

10. Bitcoin is validating a technology that will revolutionize the way we do business

Without getting into too much detail, Bitcoin uses blockchain technology – which has the potential to decrease transaction costs for everything (think buying land, making purchases online, and establishing agreements).

Without getting into too much detail, Bitcoin uses blockchain technology – which has the potential to decrease transaction costs for everything (think buying land, making purchases online, and establishing agreements).

Bitcoin is the first form of blockchain. However, blockchain technology is sometimes seen as the next greatest invention since the internet itself – as it builds an entirely new level of security around transactions.

In short, blockchain is here to stay, and Bitcoin, as an enabler and megaphone for this technology, looks like it will be around for a while.

Here's how to invest in Bitcoin…

As we wrap up this article, it's only appropriate for me to answer the question “How do you invest in Bitcoin?”.

While purchasing Bitcoin used to be relatively complex, thanks to newer websites and apps available today, buying Bitcoin is as easy as investing in the stock market or sending money with PayPal.

In the US, the most popular way to invest is to buy Bitcoin with Coinbase. Not only does this app make it incredibly easy to purchase the three most popular cryptocurrencies, but it's also FDIC insured – meaning that your investment is safe from hacks/etc., up to $250,000.

Although there are other platforms available, Coinbase is the easiest to use and most secure at this point (as it's FDIC protected).

As mentioned earlier, you can also purchase Bitcoin through the GBTC investment fund that is available on many investment platforms, including Stockpile.

The reason I like using Stockpile is because it allows the purchase of fractional shares and actually allows the creation of investment accounts for kids!

Now that you've read all the way down to the end of the article, what are your thoughts on Bitcoin and cryptocurrency?

Do you think it's a solid investment, a decent alternative to the lottery/casino, or a terrible waste of money? I'd love to read your honest opinion below.

I think the whole idea of the Bitcoin is something sinister in itself, like the setup for world currency for the NWO, to replace physical money.

That’s a reasonable thought Liz! In fact, I avoided Bitcoin for several years because I didn’t like the idea of investing in something that was used largely for illegal activities. However, I’ve become more comfortable with it as I’ve seen it used by more credible people as well.

And actually, the beauty of Bitcoin is that it can’t be tracked or pegged to a specific person — which makes it a way to protect your wealth from a New Word Order. 🙂 It could replace physical money at some point, but it would still have the flexibility and anonymity of cash (whereas your credit card purchases are easily traced and captured).

It’s good you’re thinking long-term and not getting carried away with an idea before thinking about where it could end up.

Awesome article. This is great cuz tax time is right around the corner and I want to start investing in other stocks.

Excellent Erwin! Your head is in the right place if you’re thinking about ways to invest your tax return. That’s a great first step to riches.

I know it would only be an educated guess, not knowing my personal financial situation, but what do you think would be a reasonable amount to initially invest for first-timers? Also, do you have to leave you investment in for a certain period of time or can you cash out whenever you lie? Thanks!

I obviously can’t type! 🙂

you = your

lie = like

I was just talking with a co-worker today about investing in Bitcoin and downloaded the Coinbase app after our conversation. I’m now contemplating taking the leap and making a modest investment.

While Bitcoin is still top dog and, in my opinion, a great investment, I think it’s worth looking into other cryptocurrencies as well. While Bitcoin might get the most publicity, the alt market is also doing rather well.

My thoughts exactly sure Bitcoin has gone up in value but I’m thinking that as more cryptocurrencies hit the marketplace meaning more competition / market share that buying one cheaper that’s getting its legs under it has the potential to go higher faster meaning more return on investment ???

My son invests in bitcoins and has made a lot of money. I would too if I could afford it 🙂

This is too risky of an investment for a person that is retired as I am.

Bitcoin and other altcoins can be good investments if you do your research. There have been many stories of people growing a large pool of wealth by investing in cryptocurrencies. I believe that it is a solid investment even now.

I’m extremely interested in bitcoin and have been thinking about investing for a few weeks now. I appreciate that this article listed all the positives but I’m wondering about the downsides. I have a few friends working in data sciences who are skeptical due to the high amount of energy needed for bitcoin transactions. They all seem to be quite certain that once environmentalists really understand the effects, that will be the end of bitcoin. I’m quite curious to see the outcome.

That’s a very insightful tip Patricia. An alternative that I have heard may be more stable for the long-term is Etherium. Although it may not shoot up in value as much, it seems to have the potential to have long-lasting value. I will keep reviewing this topic myself and see what happens. Either way, it’s exciting to see what’s ahead!

Ygh

well i think it is a good choice he has made alot of money for himself so if he told me to invest in Bitcoin I would do it

In 2009 knowing what I know now I would but its just to high and if block chain does not protect it a hacker can just steal it away just like your identity. Its a virtual currency, its not gold,silver or cash and only been around 7 yrs pretty scary to invest 15000 for one bitcoin. But I’m Computer Engineer so just my bitcoin.

I am extremely concerned about bitcoin. I think that the wise person will wait and see how digital currency performs. It you have enough disposable income that its potential loss would not be a problem, then give it a shot. As the old saying goes, “If something seems too good to be true, then it probably is.” The Bitcoin hype sounds a bit too good with promises of vast increases in your investment.

I’m very interested to see how this plays out.

This was very well put together.

Nice article!

Can’t wait to watch it crash

Haha! Well, that’s certainly possible. For many of us, hopefully that won’t be the case.

I enjoyed reading this article which helped unravel some of the mystery of bitcoin and other crypto currencies. I’ve had some friends that have talked about about it and I have decided to take a leap into investing a moderate amount of money. I’m not a gambler so I will only invest what I can afford to lose and hope that it pays off for me at some point. 🙂

My 15 year old son is really pushing me to invest in bitcoin. I encouraged him to do his research as I really know minimal about bitcoin. I love that he wants to get into investing. This article makes me feel a little better about it. We don’t have a lot to spend but I may give him a little so that he can do his first investment. I’ll definitely send this post to him as well.

I don’t understand why new currency is needed, to me it’s just another way for people to make money off of you.

interesting read, ive been hearing quite alot about bitcoin lately. to invest, or not to invest? that seems to be the question others may be asking themselves.

I’m not in crypto yet, but I am thinking about it in 2018 because I like the concept of blockchain technology.

As you mentioned, only invest money you can afford to lose. That’s my approach and I’m paying for some other bills before I can put aside some income for Bitcoin.

I will look into Stockpile since I use that too for fractional stock shares, I didn’t know they offered cryptoinvesting.

I am really on the fence about this. I am leaning towards it never getting beyond a certain stage. I doubt it will ever overtake the dollar (or any other traditional money), but I can see it continuing for some time and so take advantage of it while you can. I think there will be the proverbial other shoe dropping not that far in the future. But, people can and do survive on trading all kinds of stuff for all kinds of other stuff—why not trade bitcoins for services and stuff? If someone else finds bitcoins valuable, well then trade away.

I wonder if Rob still believes its a good investment now?

lol. It’s definitely slowed down for a bit (as it should). However, I’m still optimistic that it will continue to be a valuable investment for a couple more years (although long-term it’s hard to tell). As was mentioned in the article, you should never invest your life savings, but there has been a historic upside despite people speaking of it’s doom for the last 7 years. And now may be a good time to diversify into some other cryptocurrencies. Again, it’s definitely risky — but it’s a far better investment than many that people make. We’ll see what 2018 brings!

It is confusing to me. I just don’t get it!

Bitcoin is a scam in the long run. Run, run away from it.

Well written article!

This article hits all of the right points on Bitcoin and I agree that Warren doesn’t know what he is talking about regarding Bitcoin. If I’d bought Bitcoin when they were just a few dollars (or even around $250 each) I’d be a millionaire today.

I would like to know a lot more about bitcoin…..is there someone who could direct me to reliable information on the subject?

Would a crypto currency such as bitcoin make it easier managing finances if a person was living between two counties. juggling banks and different currencies is a joy.

Wow, this is a well written, and a very informative article. Some of what you wrote, I had already learned over the course of the last few months since Oct 1 when I first decided to cash out a $4 survey for Bitcoin. That $4 went up, as BitCoin was around $4,000 at that time. I now just cash out my surveys for Bitcoin, and since I’m cashing out when it’s lower, have more than doubled my payout. I do not have money to lose, but I do have some time to spare. I agree with you that the long-term potential is there, and to also not invest more in BitCoin than one can safely afford to lose.

My son has bought into the bitcoin craze and has made quite a bit of money

I think warren Buffet knows his investments so I would stay away from this for now!

I have been discussing this for years with my husband. I think we are going to do it. We have been talking about investing and setting up our own system since bitcoin was about $500 a coin. Now look at how much they are? I think it’s time we get into gear over here lol.

lol. That’s the struggle many of us have had! I’ve followed it casually for years. Should have just purchased it 🙂 Now, in addition to a little Bitcoin, I’ve bought into some of the other currencies out there, and we’ll see what happens!

I’m up over 500% on my investment from last year and that even factors in the huge plunge in January/February.

The final quarter of 2018 will be epic when the bull run starts.

I am also investing in the Chinese tokens ready for when they go mainstream such as NEO and VEN.

Go read up on it folks. Even price Waterhouse Cooper have bought into them.

Great article by the way.

Congrats Paul! It’s true, if you’re willing to hold for a year or so, most people have historically done well. We’ll see if this rings true with those who bought in at the $17k mark. And yes! I’ve bought a little NEO as well. And thanks to your tip I’ll go look into VEN a bit more. There are so many options, the trick is figuring out which ones will do well and which will fall along the wayside. Thanks for stopping by and sharing your experience!

I received 1.4 btc from btctradefarm.com after i invested 0.8 btc with them.

BtcTradeFarm is very trustworthy. I invested my btc with them and I made returns. They are truly legit.

I want to know is there is any wallet which can only be opened with multiple access… like we are 4 partners and we want to secure our company fund in a common wallet, which can not be open by any single partner, means it can only be open with all the keys/passwords/finger impression of all partners together.

I used to purchase btc from coinmama using my HDFC debit card. But since a couple of days, neither my credit nor my debit card works for purchase. HDFC is refusing the transaction. Did anyone else observe this recent development?

Hi. is using Jaxx an easy and secure way of buying different types of cryptocurrency? And if there are any other programs that you would recommend in purchasing this currency?

It’s difficult to buy Bitcoin with PayPal because most conventional exchanges don’t accept PayPal because:

Bitcoin is non-repudiatory and PayPal is not. This means that if I sell you my Bitcoin for PayPal, and you decide to lie that you didn’t get the Bitcoins I sent you for the money you sent me via PayPal, you initiate a Chargeback , PayPal reverses that transaction but I can’t reverse my Bitcoin transaction so I’m left holding the bag – you get to keep the money in your PayPal account and the Bitcoins I sent you.

Using PayPal to buy/sell Bitcoin violates PayPals terms and conditions so if I sell you my Bitcoin for PayPal, I risk getting getting my account closed or my funds frozen.

It’s therefore easier for these exchanges to stop accepting PayPal.